Monetary policy and interest rates in Ireland

16 December 2020

Blog

Last week, the ECB’s Governing Council made a number of decisions, including to keep the key ECB interest rates unchanged and to increase the envelope of the pandemic emergency purchase programme (PEPP), one of our key tools in responding to the COVID-19 crisis. As I’ve said before, our aim on the Governing Council has been to respond forcefully to the challenges from the pandemic and to do whatever it takes to deliver our mandate of price stability, putting in place the necessary conditions to support households and firms through, and out of, the crisis.

Questions that I hear quite often include “how does this impact those of us who live in Ireland?” and “if we’re in a single currency area, why are there different interest rates applying in different euro area countries?”. These are all good questions and I thought I’d use today’s blog to address them.

The short answer is that the different interest rates available to borrowers across the EU reflect different markets, different legal systems, different histories and different lenders with different legacies and challenges. But, inevitably, the short answer isn’t enough.

Central banks and interest rates

Let’s start at the beginning. Monetary policy – and delivering price stability – matters to everyone. And interest rates are a core part of monetary policy’s toolkit. They determine the costs of borrowing to start or develop a business, or to buy a house or a car, or to fund a health service or education system. They also determine how much money that’s saved on deposit will earn. Interest rates can vary depending on the purpose of a loan, the time needed to repay the loan, and the risk that the loan represents to the lender, among other things.

Interest rates for the euro area are set by the Governing Council. In fact we set three key official rates that impact on the financial system and the wider economy. These are:

ECB Governing Council policy decisions impact the economy via the banking system. The rates we set influence the interest rates commercial banks charge their customers.1

The ECB’s objective is price stability rather than a particular level of interest rates (see my blog here). Because inflation was considered too low, the Governing Council dropped interest rates to zero in 2012. And since June 2014, the rate on the deposit facility has been negative.

The degree to which changes in central bank rates lead to changes in the rates faced by savers and borrowers is referred to as “monetary policy transmission”. The evidence globally tells us that this transmission is affected by a wide range of factors.

Cost of credit in Ireland over time

While all euro area members share the same monetary policy, each Member State has its own characteristics – different market structures, borrower risk profiles and history for example – which can mean there are differences in price developments and in financing conditions across the monetary union.

As a small open economy, Ireland’s macro-financial environment is more responsive to external developments than other European countries. Our openness has been an important foundation of our economic growth in recent decades but it can also be a source of vulnerability. We are more susceptible to shocks that arise in the global economy and this risk (which is greater than for many of our European peers) is a factor in the provision of credit in Ireland.

Beyond the structure of our economy, the legacy of the 2008 financial crisis also continues to have an impact on the cost of credit. The high levels of defaults and financial difficulties experienced in Ireland factor into assessments on how to price credit today. (The relatively low levels of housing repossession in Ireland lead, at a system level, to higher interest rates as banks lose greater amounts for each borrower that enters default than they would otherwise have done.2) Another relevant factor for the cost of credit includes the relatively limited competition on retail lending to households and small to medium sized companies (and the lower levels of mortgage switching than observed in other European markets as I wrote about recently).

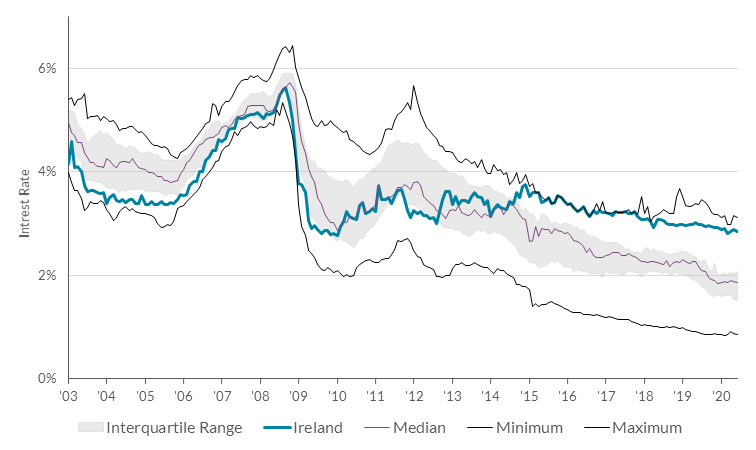

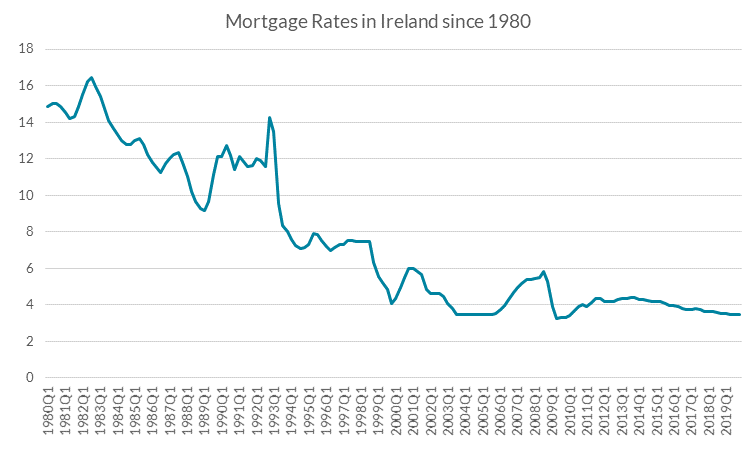

Figure 1 gives an indication of where Irish interest rates for new house purchase loans have been in comparison to some European peers (although it’s worth noting that the composition of loan types and risk characteristics are different in each country, so like-for-like comparisons are difficult). Despite remaining higher than some others in Europe, interest rates in Ireland have been on a downward trajectory (see Figure 2, although higher rates in the 1980s for example would also reflect higher inflation).

Figure 1: Interest Rates on New House Purchase Loans for European countries

Source: Central Bank of Ireland Household Credit Market Report

Figure 1 shows that interest rates on new mortgages have fallen in recent years while we’ve also seen reductions in interest rates on loans to SMEs (from 5.19% to 4.15% over the period 2015Q1 to 2020Q3).3

The fall in borrowing costs has brought credit conditions in Ireland more in line with the ECB’s overall monetary policy stance. But that fall has been slower than in other European countries where the effects of the 2008 crisis were not quite as severe. In Ireland, the decade following the crisis required significant efforts to ‘repair’ our banking sector which are likely to have affected the degree of monetary policy transmission through the Irish financial system to households and businesses. As our financial system recovered, these impediments to transmission have lessened and borrowers have experienced the benefits of the ECB’s stance to a greater degree. It shows the importance of a resilient financial system and banking sector to ensure that monetary policy measures designed to ease conditions across the whole economy feed through to everyone in the community.

Figure 2: Interest Rates in Ireland over time

Source: Central Bank of Ireland, COSMO Model

Factors affecting retail interest rates

But as I said above, the factors affecting the actual rates consumers are charged are manifold. The Central Bank has been publishing research on this topic for a number of years (see for example this 2015 report). Looking at the factors in a little more detail, they include:

- The cost of funding: Banks’ funding can come from a range of sources such as customer deposits and wholesale markets and from central banks. The mix of this funding is influenced by regulatory requirements.4 For new lending, banks consider the cost of raising new funding, usually with some reference to interest rates in the market (and often reflecting their funding mix and the interest rates on deposits to customers).

- Credit risk: Banks must also take into account the riskiness of their lending when setting interest rates as they need to consider that some borrowers may find themselves unable to pay back their loan.

- Operating costs: The costs of developing, distributing and managing the loan and the customer relationship also needs to be captured as part of the bank’s assessment of the appropriate rate to charge on new lending. (In the first half of this year the underlying cost to income ratio of the three quoted Irish banks was 76% compared 65% for a range of EU and UK peers.5)

- Cost of capital: The amount of capital that banks fund themselves with varies from bank to bank and depends on factors such as a bank’s business model, how risky a bank’s assets are or have been and other considerations on risk profile.6 And of course equity funding costs as investors expect a return on their investment.7

A bank, like other businesses, will also factor-in other considerations in its pricing depending on its strategic objectives, its risk appetite and, of course, the competition in the market.

But banks are also a special type of business in that they have an essential role within our economy and our society. They safeguard the savings of the majority of the population, act as central players in the payments network and as liquidity-creators through lending and intermediating between savers and borrowers. Our national prosperity depends on us having a well-functioning and resilient banking system. If lenders set interest rates at levels which did not cover their costs, it would impact on their resilience and their ability to provide essential services to the economy.8 The community as a whole would suffer in the long term.

The role of banks in the economy and their importance to society means they are also subject to stricter rules than most businesses. In particular, we require banks to hold sufficient capital to ensure they can sustain losses when they occur and continue to provide services to the economy as a whole. One of the significant developments since the global financial crisis (GFC) has been the substantial increase in the quantity and quality of capital that banks fund themselves with. In Ireland, for example, at the end of 2019, the three domestic retail banks had equity relative to assets of over 11% compared to 6% for wider EU and UK peers.9 Relative to risk-adjusted assets, Irish banks had equity capital before regulatory adjustments of 23% compared to 17% for peers (and 17.7% compared to 14.8% after regulatory adjustments).10 One factor leading to higher capital being held by Irish banks is higher “risk density”, the amount required to cover the risk associated with a particular asset, often expressed as a risk weighting. At the end of 2019, the risk weighting on Irish mortgages was 32% (compared to an average of about 12% for European peers), largely as a result of the level of mortgages in default in Ireland and the losses experienced by retail banks in the GFC.11

Increases in capital requirements may have reduced the return on equity received by investors (compared to pre-GFC). But we are now seeing the benefits of those policy actions in the system’s role as an absorber, rather than amplifier of the COVID-19 shock.

New lending is safer

We have learned from the experience of the GFC. In my view, the community as a whole has benefitted from the fact that lending in the Irish economy is much safer. That has been the result of better regulation, more effective supervision and the introduction of new macroprudential policies.

One of the key policies which the Central Bank introduced in 2015 has been the mortgage measures. They aim to ensure both lenders and borrowers have sufficient resilience to withstand shocks (Vasileios Madouros, the Central Bank’s Director of Financial Stability, wrote about this in thejournal.ie recently). This increased resilience is reflected over time in a bank’s capital requirements as the less risky lending gradually makes up a greater proportion of its loan book. We have seen the importance of good underwriting and effectiveness of the macroprudential rules during the pandemic: borrowers with loans originated since 2009 have been much less likely to need a payment break than those with older loans originated under previous, looser, credit standards.

Over time, we expect that these better underwriting conditions will lower the overall risk profile of Irish bank portfolios. And indeed the impact of safer new lending combined with the return of some customers to full repayment as well as actions by banks (ranging from restructuring loans to portfolio sales) have reduced the level of non-performing loans (NPLs) in their portfolios.12 The number of principal dwelling houses (PDH) accounts in arrears over 90 days stood at 5.6 per cent of all PDH accounts at end-June (compared to 12.9 per cent at end-September 2013).13

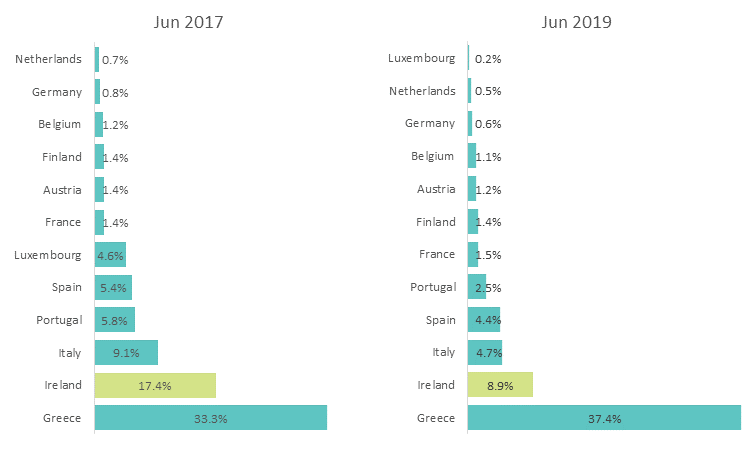

However, Ireland still has a relatively high NPL ratio compared to others in Europe (see Figure 3). As the history of the last crisis fades, the share of lending that is a legacy from the last crisis should also begin to fade. This process takes time (given that over 60% of the mortgage stock still relates to pre-2008 lending, with a still-high risk profile) but it should also lead to continued downward pressure on interest rates for Irish borrowers. And completing Europe’s Capital Markets Union (CMU) also has the potential to diversify funding options for businesses and introduce a greater level of competition. (My colleague on the Governing Council outlined the benefits of CMU in greater detail recently.)

Figure 3: IRB Retail Mortgage – Non Performing Ratio

Source: EBA EU-wide transparency exercises

Conclusion

Last week’s decisions by the Governing Council will be felt in Ireland. The effects may not be seen directly, and may not be felt immediately, but we know that the ECB’s monetary policy is transmitted across the euro area (as figure 2 indicates). Interest rates in Ireland will continue to be different to those in other Member States of the euro area as a result of our different markets, legal systems, histories and legacies. Over time, I expect that the gradual reduction in the pre-crisis vulnerabilities in loan books will continue to put downward pressure on interest rates for Irish borrowers.

This is my last blog of the year. I wish all readers a relaxing time with family and friends over the festive period, and very best wishes for 2021.

Gabriel Makhlouf

P.S. My next blog will probably be after 12 January, the closing date for the ECB’s consultation on a digital euro. If you’re interested, do share your views by then.

1 We have a number of other non-standard measures which we use to achieve our price stability objective too.

2 The Central Bank of Ireland publishes statistics regularly on residential mortgage arrears and repossessions.

3 The most recent Retail Interest Rates data from the Central Bank of Ireland, which for mortgages excludes renegotiations and is not strictly comparable with the European countries included in Figure 1, showed that the weighted average interest rate on new mortgages agreed in Ireland stood at 2.79 per cent in October 2020.

4 These include the Net Stable Funding Ratio (NSFR) which determines how longer dated less liquid assets need to be matched by longer dated funding and the Minimum Requirement for own funds and Eligible Liabilities (MREL) under the Bank Recovery and Resolution Directive (BRRD).

5 Source – Bloomberg.

6 As part of the Supervisory Review and Evaluation Process (SREP) conducted periodically by supervisors, which is mirrored by a bank’s own assessment of its risk profile and required capital as part of its Internal Capital Adequacy Assessment Process (ICAAP).

7 For equity capital, the highest quality form of capital, this is the cost to equity holders of their investment in the bank reflecting the perceived risk to future cash flows to shareholders. For other forms of capital such as additional tier 1 or tier 2 is it is the dividend rate or coupon associated with each instrument issued.

8 This feature affected the resilience of the banking sector in the lead up to the financial crisis, where we can see from Figure 1 that mortgage rates in Ireland were at the lower end of those in the EU.

9 Figures based on EBA transparency data as at end Dec-19 and additional data for PTSB which is not included in the exercise. Equity is based on CET1 capital with regulatory adjustments added back.

10 Higher levels in part reflect pillar 2 requirements under banks SREP (see https://www.bankingsupervision.europa.eu/banking/srep/srep_2019/html/p2r.en.html).

11 Based on loans whose capital requirements are calculated under the Internal Ratings Based approach, which is the basis of calculation for most Irish mortgages and also reflects risk sensitivity across countries. Data sourced from the EBA’s 2020 Transparency exercise - https://eba.europa.eu/risk-analysis-and-data/eu-wide-transparency-exercise. Figures include Irish mortgages held by any EU bank participating in the exercise.

12 For further details on household resilience, see our recent Financial Stability Review publication.

13 We are publishing updated Mortgage Arrears Data tomorrow.

Read more