Behind the Data

Non-Bank Mortgage Lending: A Look into the Interest Rate Distribution

Jean Cassidy and Cecilia Sarchi*

June 2023

Different pricing behaviours characterise developments in interest rates across the three categories of mortgage-holding entities. Compared to other entity types, the non-lending non-banks display a higher concentration of loans at both the lower and upper ends of the interest rate distribution. The range of interest rates across their mortgages has also widened markedly since late-2022.

Recent increases in policy rates have put mortgage interest rates in the spotlight once again. As the dominant form of debt held by households, an increased mortgage repayment burden can have significant implications for borrowers in terms of potential financial distress. While the key ECB interest rates increased by 350 basis points between July 2022 and March 2023, official statistics show an increase of just 75 basis points in the average interest rate on outstanding Principal Dwelling House (PDH) mortgage loans over this period. We expect, however, a wide dispersion in exposure to monetary policy changes among mortgage borrowers (Byrne, et al. 2023). Furthermore, the official statistics cover mortgages held in banks only, thereby masking the experience of the cohort of mortgages held in non-bank entities.

The motivation behind this paper is multifaceted. First, it lies in the growing relevance of non-bank entities in the mortgage market. The share of PDH mortgages (in volume terms) held by non-banks has risen from 6.7 per cent at end-2017 to 16.2 per cent by end-2022. This growth reflects the activities of two distinct sub-groups of non-bank entities. The first comprises Retail Credit Firms that are active in new mortgage lending (‘lending non-banks’ hereafter). The second includes Retail Credit Firms and Credit Servicing Firms that only hold and service outstanding mortgage loans transferred from other entities and do not initiate new loans. A key function for these entities (‘non-lending non-banks’ hereafter) is to take on and resolve non-performing loans.

The paper explores contrasting developments and changes in the distribution of mortgage interest rates for banks and non-banks over time, and highlights non-bank mortgages concentrated in the upper end of the interest rate distribution up to March 2023.

The aim of this work is also statistical, originating from the need to fill a data gap to serve the public, given the absence, until recent months, of a regular statistical collection on mortgage pricing by non-banks. This Behind the Data goes beyond the representative statistics described there, to investigate the underlying distribution of interest rates among the population of loans held in non-banks.

The data

The analysis draws on anonymised loan-by-loan data sourced from the Central Credit Register (CCR) and produces experimental statistics elaborating our own workings and estimates. The CCR contains records on loans granted over €500, where the borrower is an Irish resident and/or the loan is governed by Irish law. For the purpose of this paper, we use data on PDH mortgages that are held by the three groups of entities outlined.

Distributional differences exist in mortgage interest rates across the three entity types

In terms of the market composition in March 2023, banks accounted for approximately 80 per cent of the total outstanding value of PDH mortgages, while lending- and non-lending non-banks held shares of 8 and 13 per cent, respectively. For end-March 2023, the Retail Interest Rate Statistics reported weighted average interest rates on PDH mortgages of 3.20 per cent for banks, 3.73 per cent for lending non-banks and 5.36 per cent for non-lending non-banks. Unlike weighted averages, which provide no indication of the degree of variability in rates among the population of loans in each cohort, loan-by-loan data enable a more comprehensive picture of the pricing of outstanding mortgages.

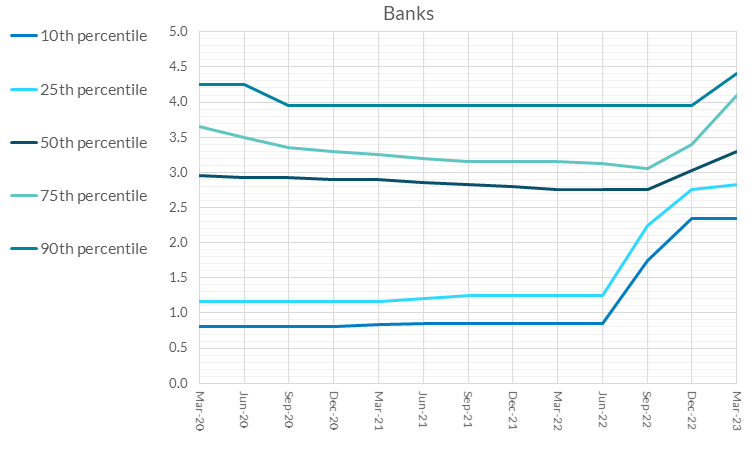

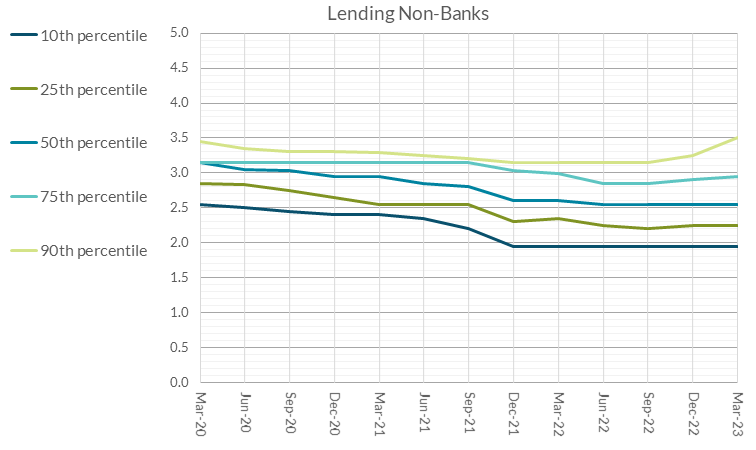

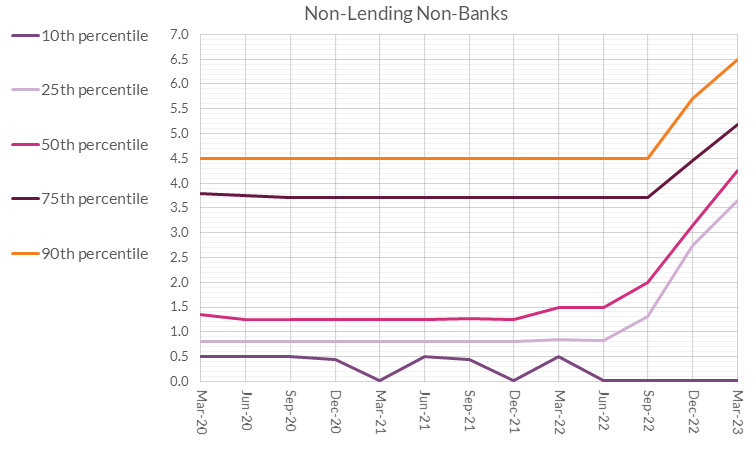

Chart 1 shows the distribution of interest rates for the entity types on a quarterly basis from March 2020 to March 2023.The distribution has been broadly stable over time for the different entities, until late-2022 after ECB rates began to increase and subsequently to pass through to retail rates at varying extent and speed. Lending non-banks’ interest rates have developed around a tighter distributional interval – the range of interest rates on outstanding mortgages is relatively narrow compared to the other entity types. This pattern has largely persisted into the latest data points, reflecting the dominance of fixed rate mortgages among this group. Banks display a narrowing of the distribution since late-2022, as previously low tracker rates moved upwards to levels comparable with other mortgage products. Conversely, the non-lending non-bank rates display a more dispersed pattern in the recent periods, when the range of interest rates across their PDH mortgages widened markedly. This evidence reflects two factors. On the one hand, the overwhelming prevalence of variable and tracker rates among this cohort has exerted upward pressures for a sizable number of mortgages. On the other hand, given the key focus of these entities on non-performing loans, the lower end of the distribution reveals a large cohort of accounts on zero per cent rates (e.g. warehoused loans).

Chart 1: Distribution of Interest Rates on Outstanding PDH Mortgages

Source: Central Credit Register and authors’ calculations.

Non-lending non-banks display a higher concentration of loans at the upper end of the interest rate distribution compared to the other entity types

A noteworthy divergence between the interest rate distributions for the different entities, as visualised in Chart 1, is the value of the 90th percentile observed in March 2023. 90 per cent of bank-held mortgage loans had an interest rate less than or equal to 4.4 per cent. For lending non-banks, the equivalent rate was 3.5 per cent, while for non-lending non-banks it was 6.5 per cent. This implies that 10 per cent of mortgages held in non-lending non-banks have an interest rate greater than 6.5 per cent as of March 2023.

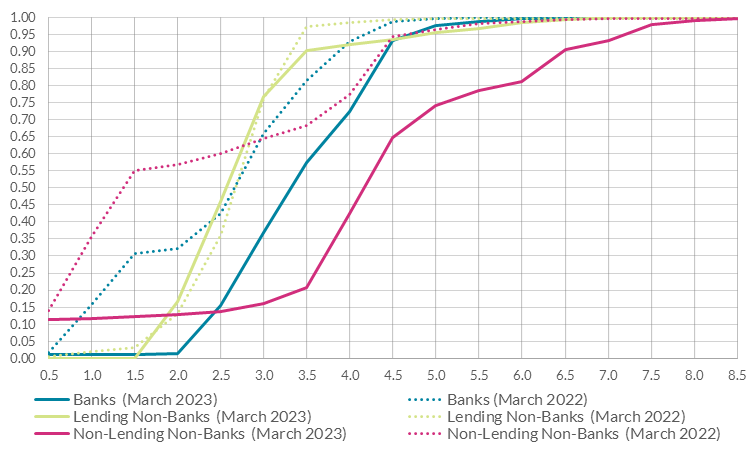

Chart 2 further explores the pricing differentials across entity types, by displaying the proportion of loans falling below given interest rate thresholds. The steeper slope of the cumulative distribution function for lending non-banks indicates the tighter range of values, where 80 per cent lies between interest rates of 2.00 and 3.99 per cent in March 2023. By contrast, a relatively higher portion of loans held in non-lending non-banks falls in the tails of the interest rate distribution. Notwithstanding the width of the upper tail of the distribution, with nearly 20 per cent of loans on an interest rate of 6 per cent or higher, only a marginal portion of loans (about 0.80 per cent) surpasses an interest rate of 8 per cent in March 2023. The cumulative distribution of bank-held mortgages broadly places between the tight distribution of the lending non-banks and the dispersed distribution of the non-lending non-banks, with interest rates amply concentrated between 2.0 and 4.5 per cent in March 2023.

The key differences in the distribution just illustrated for the most recent observation also appear to be distinctive features of the cross-entity comparison in March 2022 (dotted lines in Chart 2). Noticeably, banks and non-lending non-banks have witnessed a significant upward shift in their distribution over the past year. For example, the share of bank mortgages with an interest rate below or equal to 4 per cent was 72 per cent in March 2023, down from 93 per cent 12 months prior. A more pronounced pattern is recorded for non-lending non-banks, with the portion of their outstanding mortgages in March 2023 paying an interest rate lower or equal to 4 per cent dropping to 42 per cent from 78 per cent in March 2022. Conversely, the lending non-banks’ distribution exhibited only a milder movement in this horizon, with the portion of loans below 4 per cent declining to 92 per cent from 99 per cent.

Chart 2: Cumulative Distribution Function, Interest Rates on Outstanding PDH Mortgages

Source: Central Credit Register and authors’ calculations.

Non-lending non-bank mortgages on the highest interest rates are concentrated among a small number of entities and show a relatively higher incidence of arrears

Turning to non-lending non-bank mortgages outstanding in March 2023, we examine some characteristics of loans on a rate of interest above the 75th percentile (5.2 per cent), which merit additional scrutiny for a number of reasons. Recent supervisory work by the Central Bank has included a focus on borrowers who came into 2023 on a non-tracker variable rate of over 5 per cent with a non-lending firm. Past experience shows, for example, that higher mortgage interest rates are associated with higher incidence of mortgage arrears generally, as well as long-term mortgage arrears (Kelly and McCann, 2015; Lydon and McCarthy, 2011).

The upper quartile of the non-lending non-bank interest rate distribution in March 2023 consists of approximately 20,300 mortgages, of which 72 per cent are on interest rates below 7 per cent. The cohort in the upper quartile is found to be strongly, and increasingly over time, concentrated by holding entity. Only approximately half of the non-lending non-bank entities holding PDH mortgages are represented in the upper quartile of the interest rate distribution, compared to 81% in March 2022, while just three entities account for 99 per cent of the number of loans.

Based on proxies constructed from the CCR, the proportion of mortgages in arrears and long-term arrears, are estimated to increase as we move up the interest rate distribution. 42 per cent of accounts held in non-lending non-banks and priced above the 75th percentile result to be in arrears, the majority of which in the long-term arrears category (over one year). This reconciles with the core model for non-lending firms to resolve non-performing loans. Although these borrowers generally may not have access to the full range of other mortgage products (e.g. fixed rate products), it is worth noting that the non-lending non-banks typically have amongst the widest range of Alternative Repayment Arrangements (ARAs) for managing arrears cases.

Conclusion

This Behind the Data fills a gap in the information in the public domain by providing insights into the distribution of interest rates on non-bank PDH mortgages that are masked by aggregated published statistics. Specifically, we show that the non-lending non-banks exhibit a greater level of dispersion in interest rates compared to banks and lending non-banks. The range of interest rates on non-lending non-banks mortgages has widened since late-2022, as rates at the upper end of the distribution increased. A considerably larger share of accounts are on higher rates of interest as of March 2023, compared to the other entity types.

The paper also shines a spotlight on a cohort that may face particular challenges – loans already on a high interest rate and held in a non-lending non-bank. While households’ resilience has remained strong in the last decade, the challenge that prolonged policy rate increases may represent for the mortgagors’ debt service capacity makes it critical to measure and understand these distributional pricing experiences. Statistics in this area and the granular insights they can generate will continue to be monitored and analysed to better inform ongoing consideration of the evolution of the Irish mortgage market.

*Email [email protected], [email protected] if you have any comments or questions on this note. Comments from Vasileios Madouros, Robert Kelly, Colm Kincaid, Patrick Haran, Aisling Menton, Maria Woods, Siobhan O’Connell, Edward Gaffney, David Duignan and Paul Jennings are gratefully acknowledged. The views expressed in this note are those of the authors and do not necessarily reflect the views of the Central Bank of Ireland or the ESCB.

See also: