Insurance Corporations Statistics

Balance sheet (assets and liabilities) data for Insurance Corporations resident in Ireland (ESA 2010 sector S128). Insurance Corporations consist of financial corporations that are principally engaged in financial intermediation as a consequence of the pooling of risks, mainly in the form of direct insurance or reinsurance.

Key Points - Q3 2025

Publication date: 28 November 2025

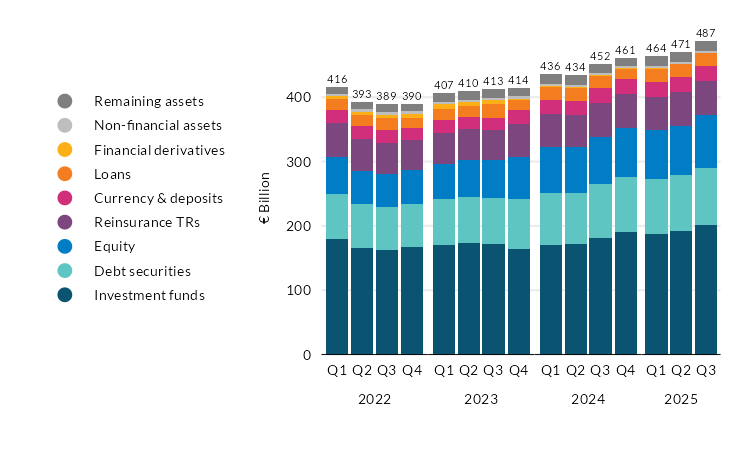

- Total assets of Irish insurance corporations (ICs) stood at €486.9 billion in Q3 2025, as shown in Chart 1. This marked an increase of €16.4 billion from the previous quarter. The largest contributors to this growth were investment fund shares/units holdings and direct equity holdings, which increased respectively by €9 billion and €6.1 billion on a quarterly basis. These two items also represented the largest annual increases, with investment fund shares/units holdings growing by €19.7 billion and equity holdings growing by €8.9 billion from Q3 2024.

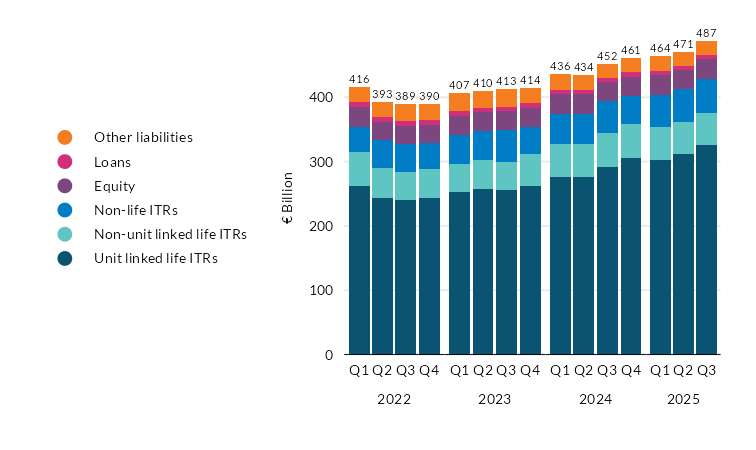

- Insurance corporations’ liabilities grew on a quarterly basis in Q3 2025, as shown in Chart 2. This primarily reflected a €14 billion increase in unit linked life insurance technical reserves (ITRs)1. Non-unit linked life ITRs remained stable in Q3 2025, while non-life ITRs grew by €1.4 billion. The growth in liabilities of €35 billion from Q3 2024 was also driven by unit linked life ITRs, which accounted for €34.2 billion of the increase.

- The Reinsurance sub-category dominates non-life ITR liabilities, accounting for €35.3 billion, as shown in Chart 3. This represents 67.6% of overall non-life ITR liabilities. The next largest sub-category was General liability, which accounted for €9.2 billion. These were followed by Fire and other damage to property (€2.6 billion), and Motor vehicle liability (€2.5 billion).

Summary Charts

Chart 1: Assets of Irish Insurance Corporations View data for chart 1

View data for chart 1

Chart 2: Liabilities of Irish Insurance Corporations View data for chart 2

View data for chart 2

Chart 3: Breakdown of Non-Life Insurance Technical Reserves – Q3 2025

View data for chart 3

Notes

[1] In the Insurance Corporation context [Insurance] Technical Reserves ([I]TRs) are liabilities relating to claims on (re)insurance corporations and assets relating to claims on reinsurance corporations.

Related Data Sets

Download the Insurance Corporation Statistics tables in CSV format.

Balance Sheet of Irish Insurance Corporations | xls 66 KB

Premiums, Claims and Acquisition Expenses Statistics | xls 26 KB

Explanatory Notes - Insurance Statistics | pdf 475 KB