Behind the Data

Surveying the Green Lending Landscape to Households and Non-Financial Corporations

Siobhán O’Connell, Sinéad Murphy and Cecilia Sarchi

November 2023

Survey data on green loan instruments advanced by Irish resident credit institutions in recent years indicates an increasing level and range of green lending to households and non-financial corporations. There is evidence that households benefit from lower interest rates on these lending products.

Climate change and its impacts on society are an ever-increasing feature of daily life. Climate related risks and the transition to a carbon neutral economy are one of the key areas of focus in the Central Bank of Ireland’s future-focused Strategy. The financial system has a critical role to play in channelling finance to green and sustainable activities, and to that end green finance to households’ and non-financial corporates are just one aspect of this. This BTD takes an initial look at the green lending landscape in Ireland through bespoke surveys of its reporting credit institutions.

These surveys are part of a range of national and international statistical initiatives and analytical work to measure and monitor the effects of climate change and related policies on the economy. The European Central Bank and national central banks have developed experimental climate indicators across three main areas, namely the exposure of financial institutions to climate-related physical risk , the carbon footprint of firms and the exposure to emission-intensive counterparties via funding channels, and the value and composition of the banks’ green securities and loan portfolios. Kennedy and Quinn, (2023) discuss the carbon intensity of resident financial firms’ securities portfolios. The Central Bank of Ireland’s new Climate Observatory provides an annual update of climate-aligned financial metrics using a combination of internal and external data sources. Other international institutions are also addressing the rising demand for statistics on green finance to serve analytical and policy functions as well as to pursue their own mandates, such as the OECD, the European Banking Authority and the International Monetary Fund. Green lending statistical indicators are a work-in-progress. These are under consideration in the complementary cost benefit assessment within the ongoing development of the integrated reporting framework (iREF) for the banking sector.

Specifically on green financing and climate risks from an Irish perspective in Ireland previous insights are available in O’Connell, (2021) in which estimates of Irish green bond holdings to end-2020 are provided, Lambert et al, (2023) in which estimates on green mortgage financing in Ireland are discussed and Adhikari et al., (2023) in which climate-related transition risk in Irish mortgage lending is analysed. For an overview of the macroeconomic implications of climate change, and the broader need for sustainable finance, see McInerney, (2022).

This BtD first provides an overview of the surveys before presenting key insights from the responses.

The Data

The Central Bank green lending survey was collected from the sample of Irish resident credit institutions, which report Retail Interest Rate statistics, during Q1 2023, after being initially run in 2021. The original survey in 2021 asked for a response based on cumulative data up to end-January 2021, while the 2023 survey sought for a time series response covering the years 2018 to 2022. The survey included both qualitative and quantitative sections. The qualitative component asked questions on institutions’ current green lending products and future green lending plans, including with respect to home loans, car and green energy loans. This Behind the Data focuses on responses received in the quantitative component. As the official statistical definition of green lending is not yet developed, responding credit institutions were asked to apply their internal categorisation. Given the range of loan products cited, definitions of green lending appear to vary across banks. Therefore, aggregate results should be considered an initial examination of the issue and may change as international and national statistical definitions are developed.

In the quantitative section, respondents were asked to report aggregated data related to the value, volume and pricing of outstanding and new loans, under the headline category of green lending products, as of end-year.

Green lending products represented 7.4 per cent of total outstanding lending to households at end-2022

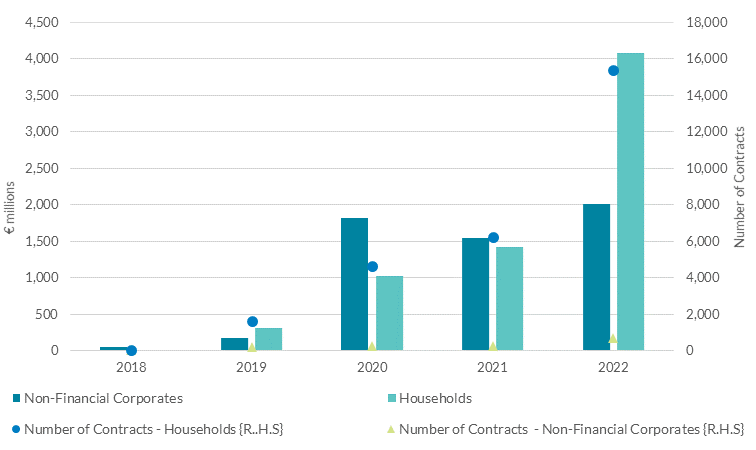

Chart 1: Increase in level and amount of reported green lending, particularly for households, to 2022.

(2023 Survey response on new Green Lending by Irish Resident Credit institutions)

Source: Central Bank of Ireland 2023 Green Lending Survey, Author’s Calculations

Chart 1 depicts data on new green lending over the years 2018 to 2022 and shows a growing market. The survey records that some €2 billion in new lending, or approx. 700 contracts in volume terms, were agreed with non-financial corporates during 2022. In terms of new green lending to households in 2022, some €4 billion was granted, equating to approx. 15,000 contracts. For context, over 2022 in total €12.7 billion in total new lending was extended to households .It should be noted that roughly 24 percent of household new lending in 2022 was accounted for by institutions who did not signal in their survey response as offering green lending products prior to that year

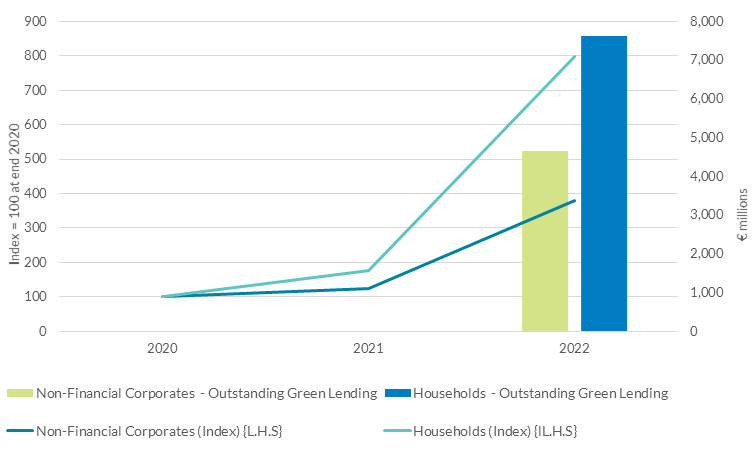

Chart 2 shows the outstanding amounts of lending at end-December 2022 to non-financial corporates and households, as reported in the survey. Overall, green lending represented some 2.3 per cent of total outstanding lending at end-December 2022. Green lending represented 7.4 per cent of total outstanding lending to households and 8.2 per cent of total outstanding lending to non-financial corporates at end-December 2022. This represents approx. 32,800 loans contracts for households and 1,500 loan contracts for the non-financial sector outstanding at end-December 2022.

Chart 2: End- Year Outstanding Amount of Green Lending by Irish Resident Credit Institutions

Source: Central Bank of Ireland 2023 Green Lending Survey, Author’s Calculations

Note: End-December Outstanding Amount

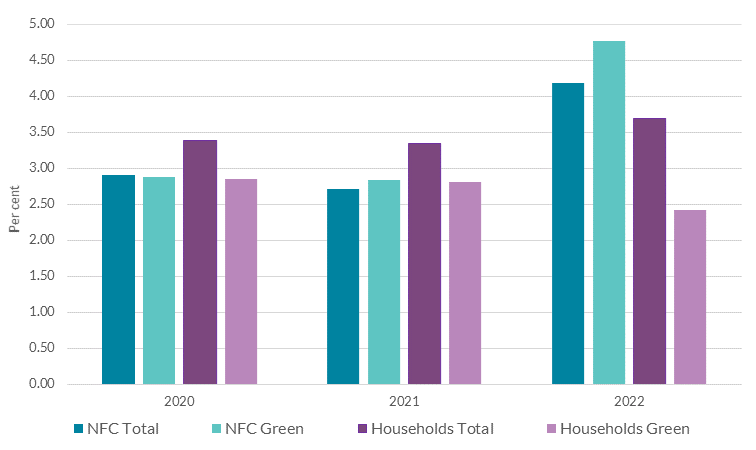

Households benefit from lower outstanding interest rates on green lending products

New lending rates for both households and non-financial corporations were lower on green products relative to non-green products, in 2022. Survey results for new lending in 2022 indicate an average rate on green lending only of 2.47 and 2.95 per cent for households and non-financial corporates respectively, as compared to a 2022 average of 3.66 and 3.38 percent when looking at total overall new lending for households’ and non-financial corporates. In contrast, the survey data show that average interest rates on the outstanding stock of green lending are roughly consistent with those on non-green lending stocks for non-financial corporates during the reference period. Lending products and lending terms such as maturity could be mixed, however, thereby challenging the comparability of the average rates across the total versus the green lending segment. In contrast, there is a clear element of a lower green rate for households in all years reported in the survey while being mindful of the limits to entry based on BER rating (BER rating B3 or higher) for home related lending. This evidence supports the finding in Lambert et al. (2023) on the expanding growth of green mortgage financing, and such correspondence resonates with mortgage lending reportedly being the largest constituent within household lending.

Chart 3: Rates on green household lending portfolios appear to be lower than on the total.

(Outstanding Lending Interest Rates, End-Year for non-Financial Corporations and Households)

Source: Central Bank of Ireland 2023 Green Lending Survey (for figures on green loans) Table B.1.2 Retail Interest Rates – Loans, Outstanding Amounts (for figures on total loans), Author’s Calculations

Note: Green weighted average interest rates are calculated based on survey responses to enhance comparability with Retail Interest Rates statistics.

Conclusion

This BtD presents for the first time initial survey data on the green lending activity by Irish credit institutions over the period 2018 to 2022. In line with Lambert et al., (2023), this BtD finds lower interest rates on green loans to households and finds that although it is currently a small but growing share of overall lending, green lending to households and non-financial corporations increased significantly in 2022.

Banks’ reported plans appear active in fostering progress in investments in climate action and contributing to the vast governmental and institutional agenda in the climate change sphere. Within the statistical sphere, ongoing developments will further enhance incorporation of green finance indicators in the years to come.

*Email [email protected] if you have any comments or questions on this note. Comments from Maria Woods ,Brian Kenny, David Duignan, Robert Kelly, Yvonne McCarthy, Jean Cassidy are very gratefully acknowledged. Thank you to Brian Kenny and Alex Keehan for assistance on data aggregations and survey response collection. The views expressed in this note are those of the authors and do not necessarily reflect the views of the Central Bank of Ireland or the ESCB.

See also: