Explainer – How can I send a payment from my bank instantly to another bank?

From 9 October 2025, all banks and relevant payment service providers (in Ireland and the euro area) are required to facilitate the sending of SEPA instant credit transfers (or “SEPA instant payments”) in euro at the request of their customers. This is mandatory under the Instant Payments Regulation.

What are instant payments?

Standard Single Euro Payments Area (SEPA) credit transfers can take up to one business day to be completed.

With instant payments, money travels from one bank account to another within 10 seconds of the payment being sent. Following the transaction, customers will receive a notification confirming that it has been completed within that timeframe.

SEPA instant payments can be made 24 hours a day, any day of the year, including bank holidays and weekends.

According to the new rules, SEPA instant payments must be made available by banks and relevant payment service providers through all existing payment channels, including online banking and banking applications.

The cost to the customer for issuing a SEPA instant payment must not exceed the cost for standard SEPA credit transfers.

While SEPA instant payments will provide numerous benefits for consumers, standard SEPA credit transfers will continue to exist as an alternative payment method.

For more information on SEPA instant payments and how they work in practice, please visit PayRightNow.ie

Sending a payment from your bank instantly to another bank

We asked members of the Irish public about whether or not they can make payments instantly from one bank to another. The responses highlighted different levels of understanding around how long payments from one bank to another can take. However, the introduction of SEPA instant payments will help remove elements of doubt by allowing consumers to use a method of payment that can transfer funds from bank to bank within 10 seconds.

Transcript of video "Can you send a payment from your bank instantly to another bank? (PDF 76.92KB)"

Verification of Payee

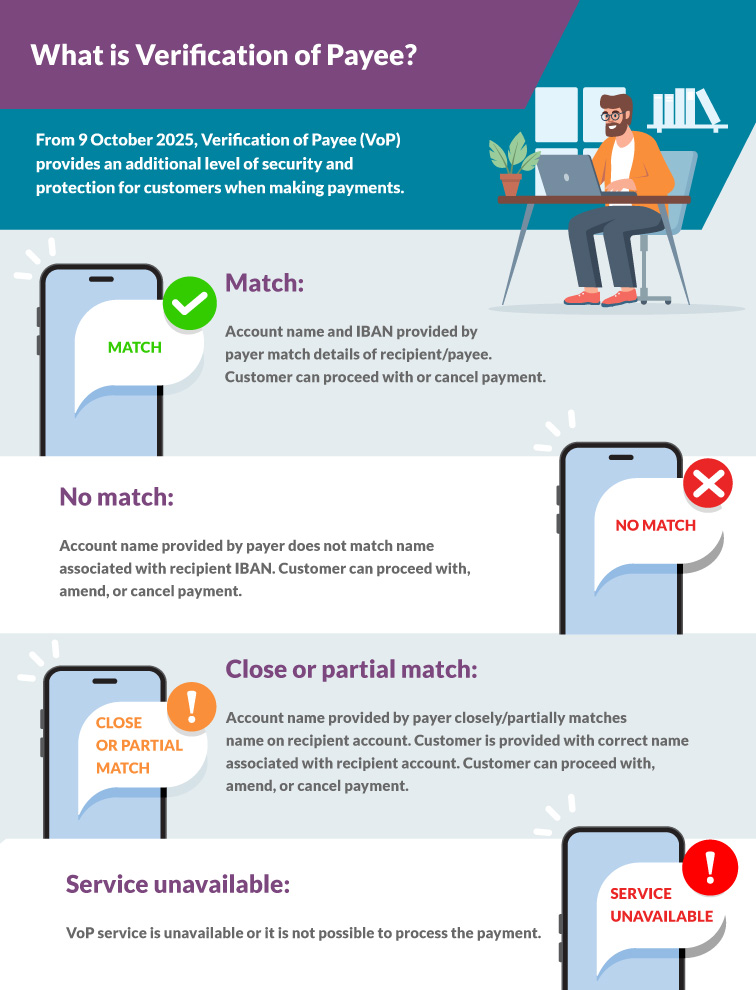

Also with effect from 9 October 2025, the Instant Payments Regulation introduces an additional level of security and protection for customers when making payments, known as Verification of Payee (VoP).

VoP verifies that the name and IBAN provided by the payer match the associated details on the recipient’s payment account (i.e. the payee).

VoP applies both to SEPA instant payments and to standard SEPA credit transfers.

Is Verification of Payee completely secure?

While VoP adds an additional layer of security, this does not fully mitigate the risk of payment fraud.

Fraudsters are becoming increasingly sophisticated, and can be very skilled at gaining your trust.

Remember to be cautious when making any payment.

Only proceed with the payment if you are confident that the payee name and payee account are legitimate, and that the request for the payment is genuine.

This is especially important when the VoP check shows that the payee’s name and IBAN do not match – proceeding could mean paying someone you did not intend to pay.

For more information about how Verification of Payee works in practice, please visit PayRightNow.ie.