The Outlook for the Irish Economy

07 July 2021

Blog

Last week we published our third Quarterly Bulletin (QB) of the year and, not surprisingly, the pandemic remains the most important factor for the economy in the near term. While there are risks to the outlook, particularly from a prolonged exit from the pandemic, the prospects for the economy have improved since our last QB in April.

The macroeconomic outlook

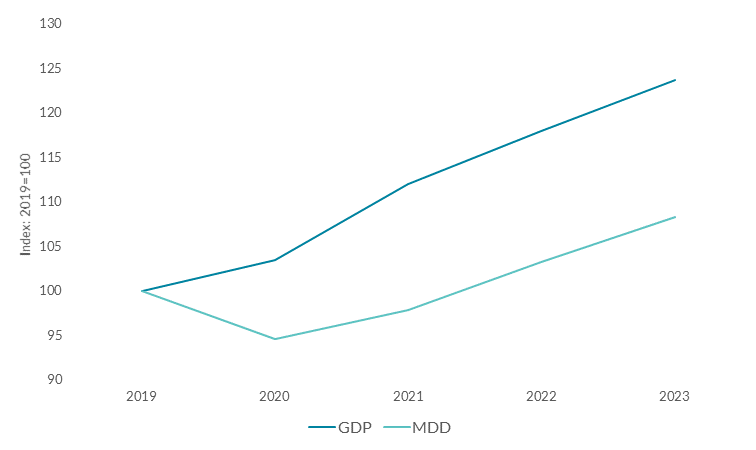

The progress of the vaccination programme is key to the outlook, while improving confidence for consumers and businesses, and supportive fiscal and monetary policy, are also important. Overall, our forecasts suggest economic activity should return to its pre-Covid level next year (see Figure 1).

Figure 1: Domestic economic activity is forecast to return to its pre-Covid level in 2022

Source: Central Bank of Ireland Quarterly Bulletin 3 2021.

Note: MDD refers to Modified Domestic Demand, which measures domestic activity but excludes volatile investment activity by multinational firms.

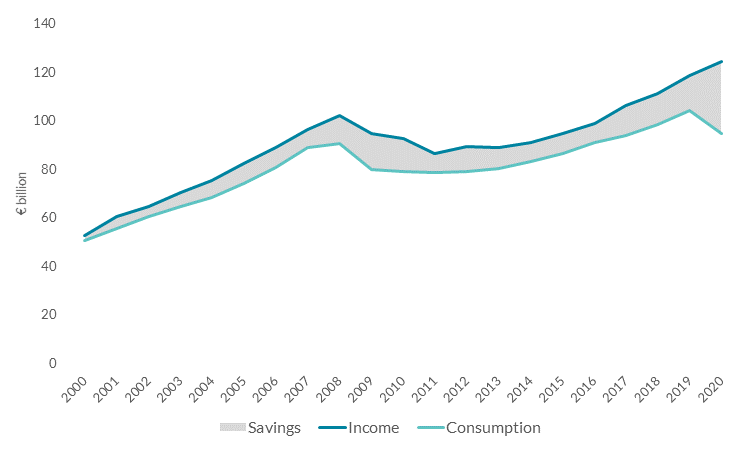

For the domestic facing sectors of the economy, we expect the gradual easing of restrictions in the coming months to support the recovery as consumption rebounds. The size of that rebound is closely linked to the savings built up by some households and individuals during the pandemic. Savings increased strongly during the pandemic as consumption was curtailed (see Figure 2). The level of savings accumulated last year was unprecedented, as the savings ratio (which is equal to disposable income minus consumption as a fraction of disposable income) rose to 23.7 per cent on average, well above its long-term average of just under 10 per cent.

How much of these excess savings are spent in the coming months and years, and how quickly, will have important effects on the economy as a whole. A key question is how much of these savings were "forced" by which I mean how much was just due to the lack of opportunities to consume goods and, particularly, services when restrictions were in place. The alternative is that savings increased for "precautionary" reasons as households and individuals were concerned about their future income prospects. The answer is likely that savings were held for both reasons, but the balance between the two will be key.

Figure 2: Savings and consumption

Source: Central Bank of Ireland Quarterly Bulletin 3 2021.

Another relevant factor is the marginal propensity to consume (MPC) or the share of new disposable income or financial wealth that is consumed by households. For example, if an individual receives an increase of €100 in disposable income and spends €15, their marginal propensity to consume is 0.15. However, the MPC from financial wealth is lower than that for income so if households view their increased savings as financial wealth, as opposed to income available for consumption, this will lead to lower consumption than otherwise. The MPC is also influenced by the age and profile of those who have accumulated savings: those who are older and have higher incomes tend to have a lower MPC than those who are younger and have lower incomes. Central Bank research (PDF 563.14KB) has shown that the accumulated savings have accrued to older and higher income households. (This issue is not just relevant to Ireland and I will discuss the European and international context in a post next week.)

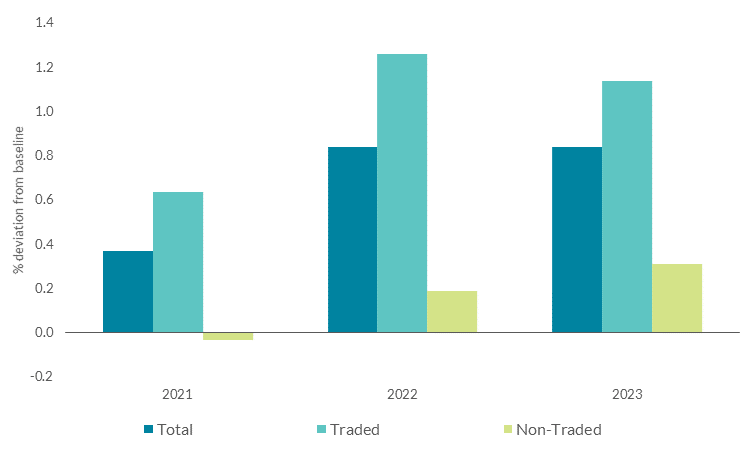

On the external side, extensive monetary and fiscal policy actions in Ireland's main trading partners and the economic recoveries taking hold should prove positive for the Irish economy in the coming years. For example, the fiscal stimulus in the United States is estimated to add just under 1 per cent to economic output here by 2022 (see Figure 3).

Figure 3: Impact of US Fiscal Stimulus on Irish Output by Sector

Source: Central Bank of Ireland Quarterly Bulletin 3 2021.

The fiscal outlook

Turning to the fiscal outlook, the measures taken by the Government in response to the pandemic were both warranted and necessary. However, as the economy moves beyond what is hopefully the last period of widespread restrictions, different challenges will emerge.

As economic conditions normalise and government supports are removed, the lasting effects of the pandemic on the economy will become clearer. While the supports offered have helped to limit the effects on workers and businesses, the pandemic is likely to have resulted in structural changes. These changes include different consumer and investor preferences, alternative ways of working, increased digitalisation and altered supply chain and migration patterns. As the economy recovers, the focus of policy should move towards helping workers who need to change jobs if their previous employer has become unviable.

And of course, the public debt ratio will need to return to a more sustainable footing, so as to ensure that resilience is rebuilt for the inevitable challenges and shocks of the future (having been drawn down to manage the shock of the pandemic).

Long-term challenges

Some shocks are by their nature unexpected, and that is when resilience is most important. Other long-term challenges such as climate change and our ageing population can be seen on the horizon (as outlined by Minister for Finance Donohoe last week in a paper for the National Economic Dialogue). I have spoken about these topics before (and I am sure I will again) but in this blog I want to highlight some new statistical data on occupational pension funds that the Central Bank is collecting.

Pensions play a key role in the economy, acting as the primary source of income to households in retirement and facilitating the long-term allocation of capital across economic sectors. They represent an important part of household wealth, and are comparable to mortgages in terms of significant lifetime financial decisions. Pension systems face a number of challenges, not just in Ireland but also around the world, including ageing populations, the low interest rate environment and the prevailing low yields on safe assets.

Given our ageing population, high quality data on pensions is essential to designing an appropriate policy response and in late-2020, we started publishing information about occupational pension funds in Ireland (this has been followed by a Behind the Data note and most recently a Quarterly Bulletin article (PDF 962.22KB)). These new statistics are helping to fill in previous gaps which left an incomplete picture and in the future I hope that we will be able to shed further light on several important elements for policy development.

Gabriel Makhlouf

Read more