Broadening the macroprudential policy framework beyond banks

30 November 2021

Blog

A key theme of the Central Bank new five-year strategy is a resolve to be future-focused. This recognises that the economy, the financial system and the world in which we operate have been changing and will continue to do so over the coming years. At the Central Bank, we want to continue to deliver our mission through such changes and that will require a shift in our focus, our analysis and our frameworks.

In that context, I spoke recently about the importance that the macroprudential framework continues to evolve and adapt, to respond to the evolution of the financial system itself. One of the most pronounced changes we have observed in recent years at a global level has been the growth in market-based finance, including the investment fund sector. Indeed, Ireland has one of the largest investment fund sectors in the world and it is a priority for the Central Bank working with our international colleagues to develop and operationalise the macroprudential framework for market-based finance, safeguarding the resilience of this form of financial intermediation.

Ireland's market-based finance sector is largely internationally focused. Most of the investors in Irish-resident funds are foreign, and most of these funds & investments are also cross-border. But there is one segment of the Irish-resident funds sector that has very close links to the domestic economy: property funds. Last week, together with our latest Financial Stability Review, we published a consultation paper to gather views on a set of proposed measures to safeguard the resilience of property funds as part of our mission to safeguard financial stability. Let me outline the rationale for these proposals.

The vulnerabilities that we are seeking to guard against

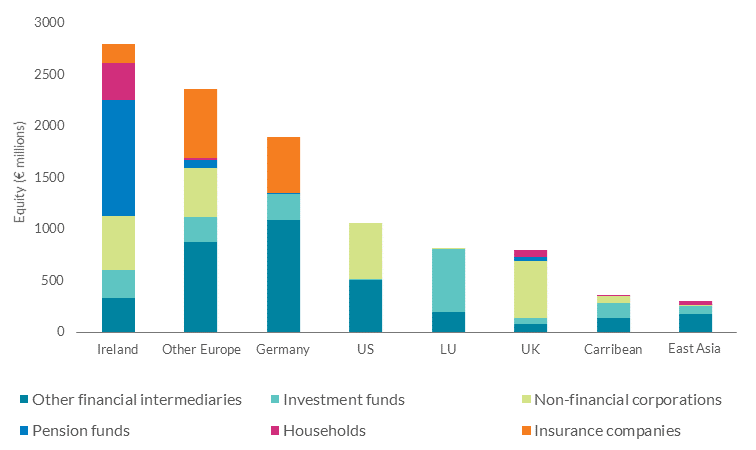

Since the global financial crisis, property funds have become an increasingly important source of funding for Irish commercial real estate. Property funds now hold around €23 billion of Irish property assets, and account for around 40% of the estimated stock of investable commercial real estate in Ireland. In turn, the majority of investors in these funds are international, reflecting the increased cross-border interest in Irish commercial real estate assets in the recent years (see Chart 1).

Chart 1 : Beneficial Investors in property funds by location and by sector

Source: Consultation Paper 145: Macroprudential measures for the property fund sector (PDF 801.66KB)

This changing landscape of financing in the commercial real estate market entails many benefits for both macro-economic and financial stability. It has resulted in greater diversification of risk and enabled overseas capital to flow into the Irish economy, supporting the commercial property market here. But the evolving nature of financial intermediation also requires us to monitor and assess potential financial vulnerabilities that it could give rise to. In recent years we have increased our scrutiny of this segment, with a particular focus on understanding better two potential sources of financial vulnerability in the sector: leverage and liquidity mismatch.

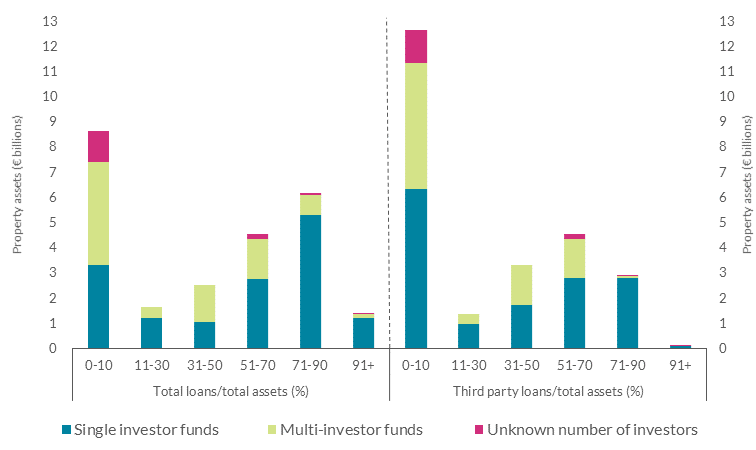

As part of this work, we have identified that some of the property funds have high levels of debt relative to their assets (leverage, see chart 2). This could be a source of vulnerability for the wider commercial real estate market in future periods of stress, if there was a shock to the economy and the commercial real estate market. In the face of such adverse shocks, lenders to highly leveraged property funds may decide to either withdraw their capital or choose not to roll over their loans. As a result, some of the property funds may be forced to sell some/all of their property in a short period of time, making the shock worse.

Chart 2: Distribution of property assets by property funds' leverage

Source: Consultation Paper 145: Macroprudential measures for the property fund sector (PDF 801.66KB)

A cohort of property funds also have a mismatch between how quickly investors in the fund can expect to withdraw their investment and how quickly the fund will be able to sell the assets (mainly commercial buildings) to pay investors (liquidity mismatch, see table 1). Again, this mismatch could be a source of vulnerability if there was a shock to the economy and many investors decided to withdraw their investment at the same time. This may also force the funds to sell property into a market that may be already sluggish or falling.

Given the amount of commercial real estate these funds now hold, collective forced sales could overwhelm the market, leading to overcorrections and market dislocation, which in turn could have broader macro-financial implications, including on the balance sheets of other financial institutions, the availability of credit or investment and employment.

Table 1: Comparison of property funds' property liquidity and liquidity timeframes (€ billions)

.png?sfvrsn=2dce921d_2)

Source: Consultation Paper 145: Macroprudential measures for the property fund sector (PDF 801.66KB)

Our proposed response

In that context, we felt that there was a role here for a macroprudential intervention, as part of our mission to safeguard financial stability. Left unchecked, some of these vulnerabilities would have the potential to grow into the future.

The aim of our proposal is to safeguard the resilience of the Irish property fund sector and to do so before adverse shocks hit. A more resilient sector will be better able to absorb rather than amplify adverse shocks. In turn, this improved resilience will help the sector to continue to serve its purpose as a valued and sustainable form of funding for the Irish economy.

To achieve that objective, we are proposing a set of macroprudential measures, introducing limits on leverage in the property funds sector as well as additional guidance on existing regulation to reduce liquidity mismatches. In my view, these proposals are a measured response to the vulnerabilities identified. However, I am also aware that this is a new frontier for macroprudential policy. It is important not to simply act, but to take the time first to listen and reflect. We are therefore consulting on the details of these proposals, from now until February 18, 2022. This consultation is open to everyone.

It is also worth pointing out what this proposal is not. It is not a proposal to regulate the types of property assets that funds can hold, for example. It is certainly not about trying to limit the amount of property fund investment in Irish commercial real estate. Nor is it about trying to control commercial real estate market prices. Our objective is very much focused on financial stability and safeguarding the resilience of this form of financial intermediation.

What impact will this proposal have?

Our proposal reflects the importance of commercial real estate to Irish financial stability and to the domestic economy. It also recognises the valuable contribution that property funds make to Ireland. It helps to ensure that this contribution is resilient and sustainable, even in the face of a potential future shock.

Ireland is a small, open economy, with diverse links to Europe, and to the rest of the world. Irish commercial real estate markets have therefore historically been more volatile than in many larger, less open economies. Our proposals would help Irish property funds to withstand any future domestic or international shocks that they might face.

The proposal would also bring Irish property funds into line with their European peers. Other large markets in Europe, such as Germany, already have some regulations in place that help to increase the resilience of their property funds. The average leverage for property funds in Europe is a little over half of the average for property funds in Ireland. This proposal would bring us more in line with other European countries.

Finally, we have considered the possible impact of these new measures on the wider commercial real estate market and will take a measured approach to introducing any changes, should we go ahead, being aware of the importance these funds to the market. We are suggesting a three-year transition period for the proposed leverage limit, over which existing property funds can slowly bring themselves in line with the proposals and during which we can monitor and assess their progress.

Conclusion

Our proposal represents a new way forward for macroprudential policy. We are proceeding cautiously, but with determination, in this area. We expect to continue to tackle the new frontier by enhancing and expanding our framework to other areas where non-banks might one day pose risks to Irish or international financial stability.

At the same time, we are continuing to engage with our international colleagues. Beyond property funds, the broader Irish investment funds sector is focused outwards. It is therefore an ongoing priority of ours to continue to develop and operationalise the macroprudential framework at a global level. We are working with our colleagues internationally, including at institutions such as the European Systemic Risk Board, to achieve this goal.

Gabriel Makhlouf

Read more:

European economic governance