The latest economic outlook

23 April 2021

Blog

At yesterday’s meeting of the ECB’s Governing Council, we discussed the outlook for the euro area economy and decided to reconfirm our very accommodative monetary policy stance, keeping the key ECB interest rates unchanged, continuing with our net asset purchase programme, and providing ample liquidity through our refinancing operations. These measures help to preserve favourable financing conditions for all sectors of the economy, which remains essential to reduce uncertainty and bolster confidence and underpin economic activity as well as safeguard medium-term price stability.

Unsurprisingly, the pandemic continues to be the key factor affecting economies worldwide. The near-term outlook remains clouded by uncertainty about the resurgence of the pandemic and the roll-out of vaccination campaigns. Persistently high rates of COVID-19 and the associated extension and tightening of containment measures continue to constrain economic activity (although the recovery in global demand and the sizeable fiscal stimulus are supporting global and euro area activity).

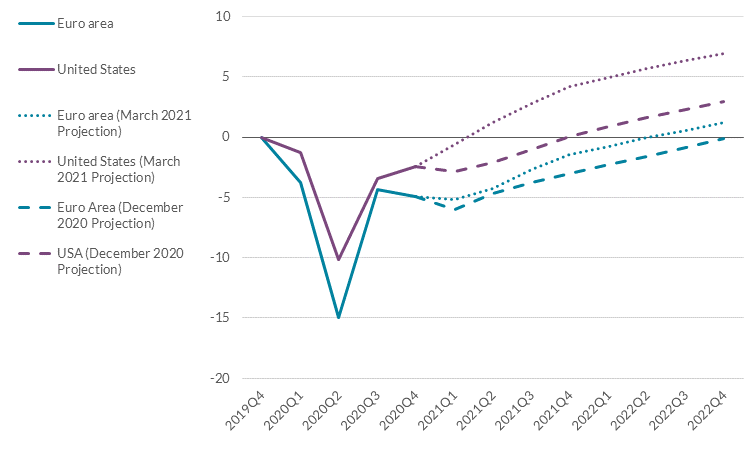

In contrast to 12 months ago, optimism has increased against the backdrop of increased vaccinations and fiscal supports, particularly in the US (see Figure 1).

Figure 1: OECD Macroeconomic Projections

Source: OECD March 2021 forecasts updates.

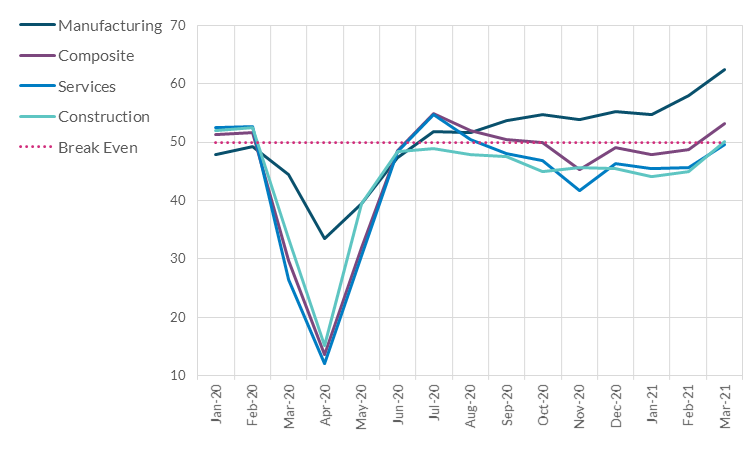

This optimism holds for the euro area as well, as the IMF also confirmed in its latest forecasts. While euro area GDP growth in the first quarter of this year was likely negative (in comparison to the last quarter of 2020), forward-looking indicators are telling a more positive story. Survey data (from Purchasing Managers' Indexes or PMIs) shows services, construction and manufacturing entering what is referred to as the “expansionary zone” (see Figure 2, this is the first time this has occurred since pre-pandemic). As for prices, inflation has increased in recent months, although there are a number of temporary and idiosyncratic factors behind that. The reality is that underlying price pressures remain subdued.

Overall, progress with vaccinations and the gradual relaxation of restrictions to economic activity underpin the expectation of a firm rebound in economic activity in the course of 2021.

Figure 2: Euro Area PMI

Source: IHS Markit. Data show a diffusion index where values >50 suggest an expansion and <50 suggest a contraction in economic activity.

The economic effects of the pandemic in Ireland

Turning to the Irish economy, earlier this month we published our second Quarterly Bulletin of the year and, like elsewhere, the pandemic remains the key factor affecting the economic outlook. And, similar to the rest of the euro area, increasing vaccinations offer hope of a return to normality and the associated recovery in economic activity(something also reflected in the Government’s draft Stability Programme Update published last week).

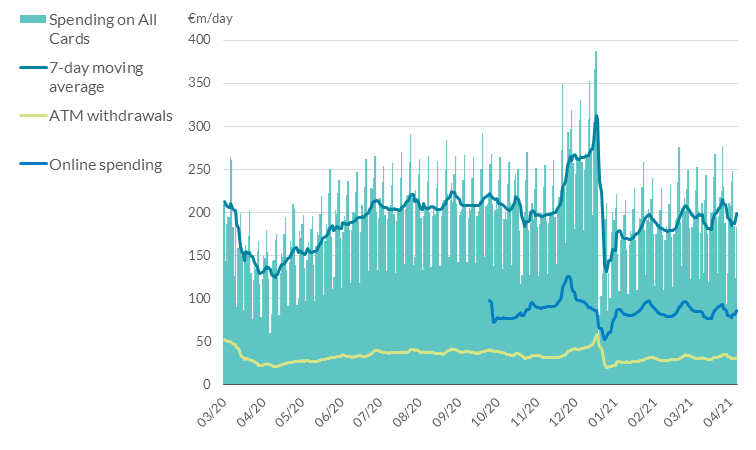

Data for last year shows the effects on the Irish economy from COVID-19, with personal consumption falling 9% due to a combination of restrictions reducing opportunities to spend and economic uncertainty reducing the willingness to spend. Credit and debit card payment data show that spending between January and February this year was about 10% lower than the same period in 2020, before the pandemic hit (see Figure 3). However, there is some evidence that consumers and firms have adapted to the restrictions this year, as card payments last month were significantly higher than payments in April and May last year, when similar restrictions were in place.

Figure 3: Daily Spending on Credit and Debit Cards

Source: Central Bank of Ireland Credit and Debit Card Statistics

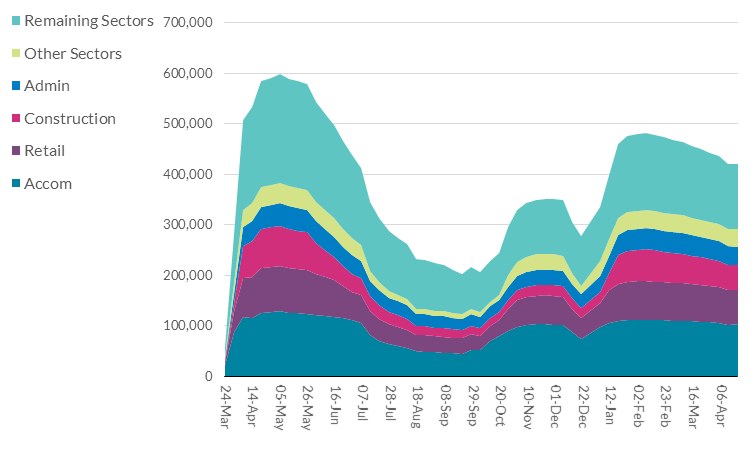

The labour market continues to be severely affected by the pandemic; COVID-19 adjusted unemployment remains high and was 24.8 per cent in February. The number of pandemic unemployment payment (PUP) recipients remains elevated, with an increase in recipients in the construction sector, in comparison to the October and November lockdown.

Figure 4: PUP recipients by sector

Source: Department of Employment Affairs and Social Protection

An important part of Ireland’s ‘economic story’ has been the resilience of its export sector, in contrast to the very difficult domestic conditions. However, strong export growth was not uniform across businesses, largely accounted for by exports of pharmaceutical products and computer services. Indigenous exporting firms are likely to see a slower recovery, in line with the recovery in demand in our main trading partners

As with the rest of the euro area, the gradual relaxation of restrictions to economic activity offer the expectation of a rebound in economic activity beginning in the second half of the year. Consumption should increase significantly with the easing of restrictions while the spending of some of the accumulated savings of households may also contribute.

Fiscal policy will also continue to play an important role in supporting the economy and the recovery. As the Governing Council reiterated yesterday, an ambitious and coordinated fiscal stance across the euro area remains crucial, as premature withdrawal of support would risk delaying the recovery and amplifying longer-term ‘scarring’ effects. (The Next Generation EU package has a key role to play and needs to become operational as soon as possible.) But we also know that policymakers will have choices to make as the economy reopens and supports are gradually withdrawn.

The picture for SMEs

Earlier this week I discussed the challenges for SMEs related to the pandemic. The shock to SME revenues was severe and research published (PDF 2.88MB) by the Central Bank, in collaboration with colleagues in the ESRI, shows that, while the hospitality sector has experienced the most severe crisis – which is to be expected given the nature of public health restrictions – the revenue shock has also been significant across all other sectors. SMEs in manufacturing, construction, wholesale/retail, business services and a group of miscellaneous sectors all experienced average revenue declines of between 20 and 25%.

A key question for policymakers (and business owners) is to identify businesses that are viable and can operate into the future, and those which won’t be able to. So far, policy choices have avoided widespread insolvencies but it is an unfortunate reality that the effects of the pandemic on SME balance sheets (combined with structural changes that have either been created or exacerbated by it) mean that some of them will be unviable. It would be a mistake to continue with protection and forbearance in perpetuity, just as it would be wrong to allow all businesses making losses currently to fail.

The complex challenge for all of us involves identifying the right time to withdraw support and to allow the market to function normally again. An assessment of business viability will ultimately depend on a range of firm and sector specific features.

Conclusion

Policymakers will continue to provide support to the economy through the challenges brought on by COVID-19. I am hopeful that we are approaching better days and that an economic recovery can take hold later this year. But the fact is that we have yet to see the full economic impact of the pandemic; we know it is coming and we need to prepare for it. There will be some difficult choices to make. For policymakers, the guiding principle should be to ensure that the recovery takes hold and gathers momentum before we then turn to the challenge of building back the resilience that has served us so well through these difficult times.

Gabriel Makhlouf

Read more