2020 – A year to remember and a year to forget

25 January 2021

Blog

Later today, I will give a speech focusing on the economic outlook for the year ahead but in this post I want to look back at what has been an extremely difficult year for people all over the world. The public health emergency has been severe and, although thankfully great progress has been made on a vaccine, we still have a way to travel to return to some semblance of normality.

The economic shock

Our focus in the Central Bank has been to try and contain the economic effects of the crisis and do everything in our power to protect consumers, households and businesses. In my first blog post, I mentioned that the economic crisis arising from the pandemic had no precedent in modern history and I have still not found examples of economies voluntarily closing down in the way so much of the world has chosen to.

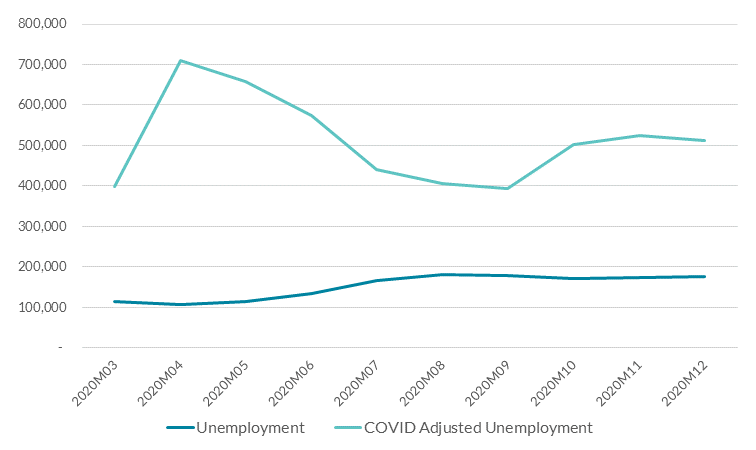

Governments and policymakers across the world took action to help economies through the crisis, providing significant income support to households and firms. The uniqueness of the crisis has complicated standard economic statistics. For example, the scale of the shock in Ireland would not be clear from analysing standard unemployment measures as in Figure 1. In light of this, the Central Statistics Office published an alternative COVID-19 adjusted unemployment measure to estimate the share of the labour force that was not working due to unemployment or who was out of work due to COVID-19 and receiving the Pandemic Unemployment Payment. These figures give a more realistic sense of how swiftly and severely economic conditions deteriorated from March last year. And even this figure does not capture the whole picture, when including individuals employed by firms availing of the Temporary Wage Subsidy Scheme; at its peak last year, approximately 1.2 million people (PDF 1.22MB) were in receipt of some form of income support. Some recent research (PDF 1.16MB) has also highlighted that job losses have been distributed unevenly through the population and have been greater for younger, non-Irish, and part-time workers as well as those in jobs for less than 12 months.

Figure 1: COVID-19 labour market effect

Source: CSO

Trends from 2020

The effects of the pandemic will remain with us even after widespread vaccination alleviates the public health emergency.

In the very first speech I gave as Governor in November 2019 in Waterford, I spoke about the importance of resilience through transitions. One of the key transitions I highlighted that society needed to grapple with was the pace of technological change, citing the example of ‘the very money in your pocket’.

Even then I could not have imagined the wider technological transition that was just around the corner as a result of the pandemic, with millions of people working from home, videoconferencing, shopping and learning online. And I expect some of these changes will outlast the virus.

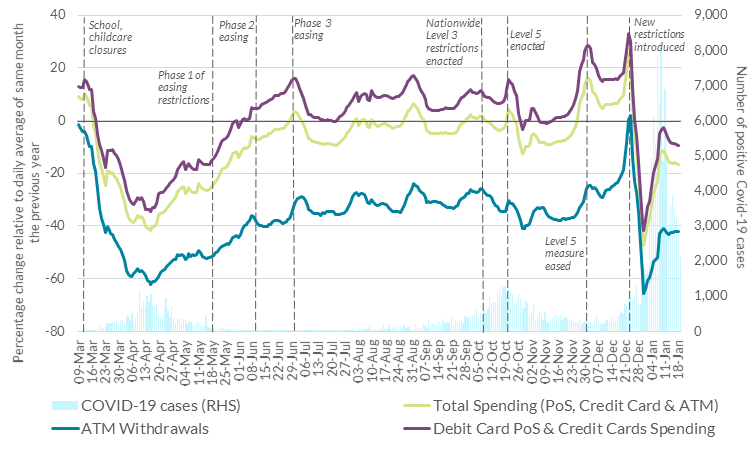

One area where we at the Central Bank have been able to observe significant change is how money is being spent in Ireland (last week we published an article (PDF 726.39KB) discussing cash usage in greater detail). As the virus reached our shores in March and measures were taken to reduce its spread, total spending fell sharply (see Figure 2). As to be expected, given reduced opportunities to spend money physically in shops, restaurants etc., ATM withdrawals fell by more than spending through debit and credit cards. We can see that while total spending recovered to 2019 levels through the summer, ATM withdrawals did not, suggesting that cash usage reduced in comparison to increased card payments.

Figure 2: Card Spending and ATM Withdrawals Relative to 2019

Source: Central Bank of Ireland

Notes: Card data are calculated as 7-day moving averages.

It is too early to draw definitive conclusions as to whether cash usage will remain below its pre-pandemic levels but it seems likely that at least some of the increased digitalisation associated with the onset of COVID-19 will remain with us in the future. How digitalisation in the financial system and the payments landscape evolves is a key focus of the Central Bank of Ireland and the Eurosystem more widely. From our perspective, while innovation in payments is welcome and provides a better experience when shopping/consuming, having an adequate supply of cash in the economy remains an important part of an effective payments system and protects the best interests of consumers.

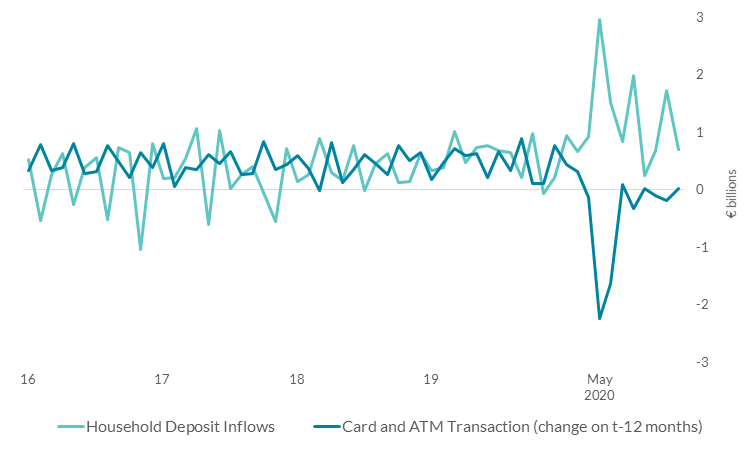

Another key trend of 2020 for the Irish economy has been the increase in savings for some households in Ireland (Figure 3 shows increased household deposits through 2020). The savings ratio - the percentage of gross disposable income saved by households - rose significantly in 2020, to levels well above historical estimates of the savings ratio (35.4% in the second quarter of the year), which have more often than not been below 10% (and have not exceeded 20% as far back as 1944).That this happened during a severe reduction in economic output highlights the unusual nature of the COVID-19 shock. Precautionary behaviour and an inability to spend dampened consumption, while extensive Government support supported incomes. And given the shock affected some sectors severely and others much less so (PDF 1.13MB), individuals who were able to work remotely did not experience falls in their income. What happens to these savings will be important for the Irish economy (PDF 441.9KB) as individuals and households may choose to use them for consumption in the future when circumstances allow.

Figure 3: Household deposit flows and change in card and ATM transactions

Source: Central Bank of Ireland Calculations.

Notes: Card and ATM Transactions” are calculated as the difference between total card and ATM transactions in a given month and the same month of the previous year.

Conclusion - resilience and recovery

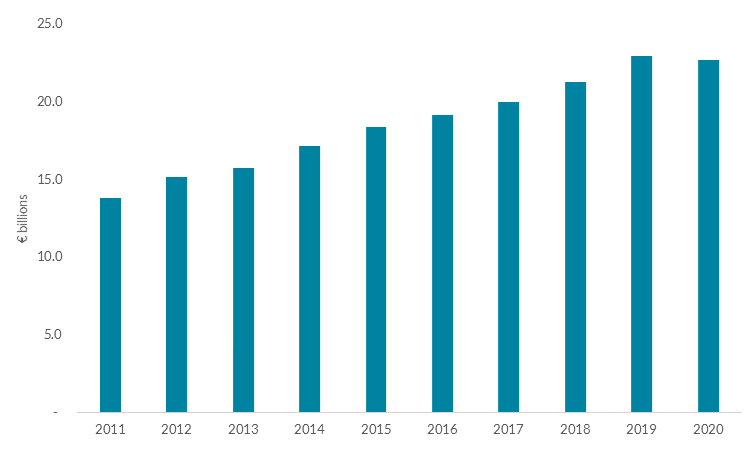

The last economic outcome from 2020 which I wish to mention in my blog today is the outturn for income tax in Ireland. Income tax returns were down somewhat but held up remarkably well given the severity of the economic shock (see Figure 4). In some ways, this reflects how the economic effects of COVID-19 are spread unevenly across the population, similar to how savings increased overall. And it also reflects Ireland’s progressive income tax system, where earners with lower incomes (who were disproportionately affected last year) pay relatively lower shares of income tax.

Figure 4: Income Tax Returns

Source: Department of Finance

The relative resilience of the public finances overall should contribute to economic recovery in 2021 as widespread vaccination allows the economy to start functioning normally again.

As I mentioned above, later today, at a (virtual) speech in University of Limerick, I will talk about the outlook for what hopefully will be a better year ahead.

Gabriel Makhlouf

Read more